In chapter four of Decoding Health Insurance, writer Lauren Jahnke talks about employment-based health insurance. It may surprise you to read that half of Americans have employer sponsored health insurance.

The past 12 months have been tough for a lot of people because the pandemic caused massive unemployment. According to the Upjohn Institute, by June 7.7 million workers lost their jobs and their employment sponsored insurance (ESI). This was just two months after lockdowns started. If you’ve heard that the numbers are much higher than that, you’re right. When you factor in spouses and children, roughly 14.6 million individuals are at risk of losing health insurance. Fortunately, a few days ago it just got easier for the unemployed to get health insurance.

Employer Sponsored Health Insurance Numbers

The Kaiser Family Foundation breaks down, state by state, the percentage of employer sponsored health insurance enrollees in 2019. For example, 60% of Utahns got medical insurance from their workplace. On the other hand, just 36% of people living in New Mexico did. It may not seem like 2019 is that far off, but in terms of employment and health insurance stats, it’s a lifetime ago.

American Rescue Plan

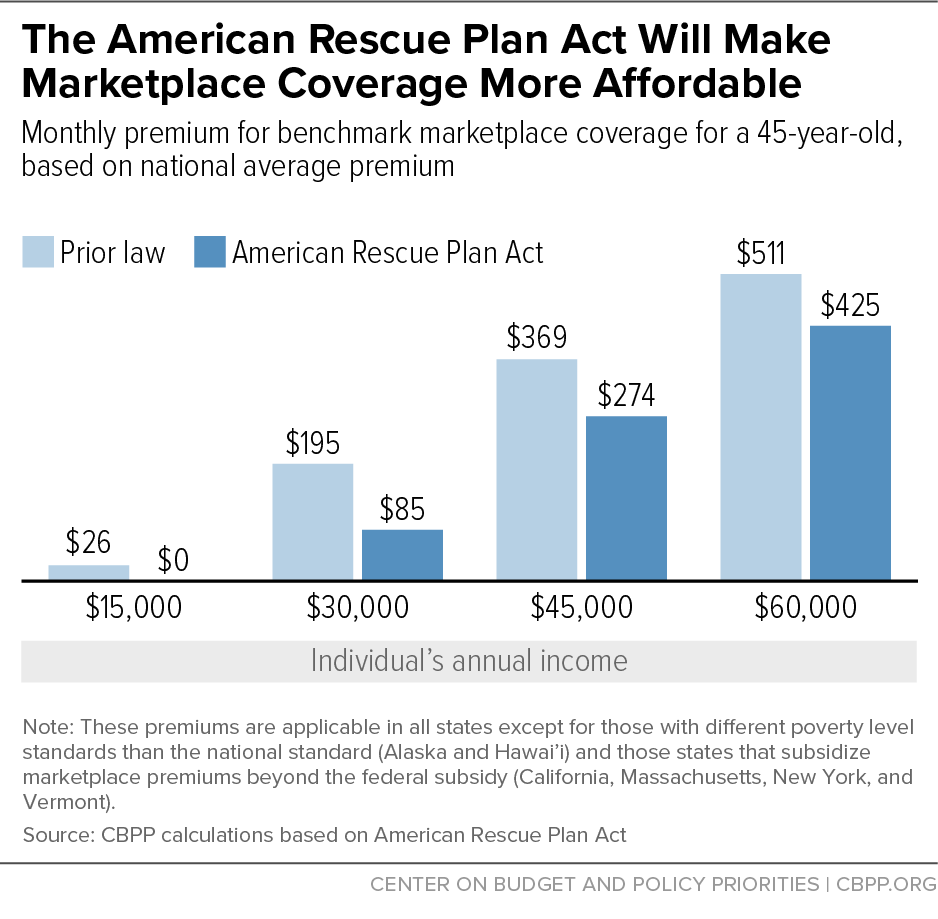

On March 10, 2021, something pretty remarkable happened: Congress passed the American Rescue Plan. But that’s not actually the spectacular part, especially if you believe $1.9-trillion price tag is entirely too high. But rather, policies in the sweeping bill will expand ACA coverage to more Americans and lower prices across the board. It will be a lifesaver for the families and individuals who lost their ESI. The improvements to the ACA “will largely reward middle-income individuals and families,” according to the New York Times. The Pew Research Center estimates that comes out to roughly 52% of Americans.

We now know the American Rescue Plan will be a boon for unemployed workers who are considered upper-middle income earners.

Hey, do you want to see which income tier you’re in? Just go to Pewresearch.org and provide your state, metro area, household size and income.

That’s because after losing their ESI, those workers can either continue on their work-based health insurance, which happens to be very expensive, or they can get a health plan from the insurance marketplace. Before President Biden signed his landmark bill, if you earned more than $51,040, you didn’t qualify for federal tax subsidies (the amount the government kicks in) for your health insurance through the ACA marketplace. But depending on where you live, $50k may not go very far. So even though you earned 400% over the poverty line, you still may have been priced out of purchasing a health insurance.

Unemployed Workers Qualify for a Free Silver Plan

One of the provisions in the American Rescue Plan is to end the income cap. “Regardless of your income,” says New York Times reporter, Margot Sanger-Katz, “if you collect unemployment insurance at any time this year, you will qualify for a free silver plan with special bonus coverage that will lower your deductible and co-payments.”

Additionally, for everybody else, insurance premiums are going to be capped at 8.5% of income. And taxpayers who received too much money in health care subsidies in 2020 won’t have to pay the money back.

COBRA

The Covid relief bill also provides a safety net for unemployed workers who elect to continue on their ESI via COBRA (Consolidated Omnibus Budget Reconciliation Act). COBRA affords individuals the opportunity to retain their health insurance plan for 18 months after leaving a job. But it also happens to cost a lot of money. Financial consultant, Dave Ramsey, wrote that choosing this path, “means you could be paying average monthly premiums of $569 to continue your individual coverage or $1,595 for family coverage—maybe more!”

Finally, health insurance enrollment was extended to mid-May (from February). No matter where you stand on the cost of the American Rescue Plan (yes, we can all agree that nearly $2 trillion is a breathtaking amount of money), if you’re someone who relied on employment for you or your family’s medical insurance, you either lost your job or went from full-time to part-time, and no longer qualify for ESI, this bill has your back.

Read Decoding Health Insurance

If you’re a small business owner or an individual interested in how health insurance works, check out Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. You’ll find information about private health insurance plans, employer sponsored health insurance, and important information about medical plans.