Health insurance literacy is just a fancy way of saying that you have a thorough understanding of your health insurance coverage and benefits. Why is health insurance literacy so important? Your family’s health and finances depend on it.

Health Insurance Literacy Definition: An individual’s ability to seek, understand, select, and use their health insurance services.

National Institutes of Health

Why Is Health Insurance Literacy Important

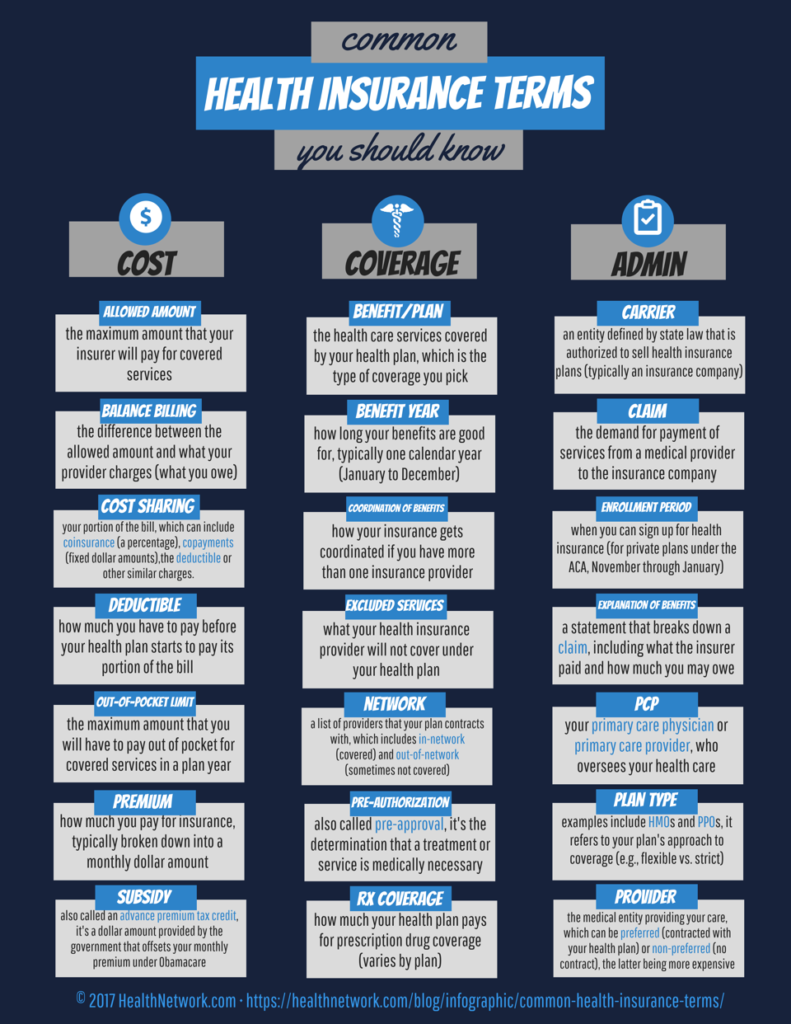

It’s no secret that health insurance companies love using big, complicated words, and tons of acronyms (e.g., PCP is short for primary care physician and ED means emergency department). CEOs say their goal is to make policies easier for ordinary consumers to understand. But, oftentimes, it does the exact opposite.

If the documents and brochures you get from your health insurance company look like gibberish, you’re not going to read them. If you don’t read your policy, you won’t understand your benefits. In 2018, JAMA published a health policy investigation linking health insurance literacy and avoiding healthcare services. The authors found that fewer than 14% of participants correctly answered questions designed to evaluate their basic understanding of health insurance. Ultimately, the study demonstrated that most consumers don’t understand their health insurance policy, which increases the likelihood that they’ll avoid medical treatment, even for preventive health care services.

Health Insurance Literacy Matters: How you can save hundreds of dollars a year

There is good news: When consumers read patient education materials and then immediately talk about that information with their doctor, they’re less likely to go to the ER and get admitted to the hospital. This research found that when patients have a better understanding of their insurance plan and benefits, they save about $675 annually and reduce their overall healthcare costs by 11%. (The cost today, using a basic inflation calculator, is nearly $782.)

Being Health Insurance Literate Is Easier Than You Think

Health insurance literacy starts at your doctor’s office. When you talk to your medical provider about your health and treatment options, if there’s something you don’t understand, ask for an explanation. Also, check out your copy of Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. This books uses down-to-earth language to explain how health insurance works.

Also, talk to the folks in the billing department. No one knows more about the ins and outs of health insurance policies than the billing clerks at medical clinics and hospitals. You should also take advantage of your health plan’s customer service platform. When you have a question about what your insurance covers and what your out-of-pocket costs are, ask a customer service representative to give you a straight answer.

Billing agents at the doctor’s office and health insurance company can’t tell you what services you need or what coverage you qualify for, but they can tell you what insurance companies are more likely to cover. In some cases, you will still need official approval from your insurance company.

Health Insurance Abbreviations & Acronyms You Need to Know

An acronym is when you form a new word using the first letters of a phrase of group of words. An abbreviation is a shortened version of a word. Health insurance companies love acronyms and abbreviations. It’s understandable why. Many common words associated with healthcare are long or difficult to pronounce. Also, terms to describe health care services are often two, three or four-words long. It’s easier to shorten Affordable Care Act, for example, to ACA. Here are other popular health insurance abbreviations and acronyms you should know.

- ADA – Americans with Disabilities Act

- ADL – activity of daily livingFSA – flexible spending account

- ALOS – average length of stay

- ARP – American Rescue Plan

- Auth – authorization

- CHIP – Children’s Health Insurance Program

- COBRA – Consolidated Omnibus Reconciliation Act

- COI – certificate of insurance

- DOS – date of service

- E&L – exclusions and limitations

- EAP – employee assistance program

- ED – emergency department

- ER – emergency room

- FFS – fee for service

- FMLA – Family and Medical Leave Act

- HDHP – high deductible health plan

- HIPAA – Health Insurance Portability and Accountability Act

- HMO – health maintenance organization

- HSA – health savings account

- OOP – out-of-pocket

- OTC – over the counter

- OV – office visit

- Remit – remittance

- Retro – retroactive

- Rx – prescription

- Par – participating

- PCP – primary care physician

- Pre-auth – pre-authorization

- Pre-X – pre-existing conditions

- POS – point of service

- PPO – preferred provider organization

- WH – withhold

- YTD – year-to-date

Benefits of Being Health Insurance Literate

Yes, health insurance literacy can be extremely time consuming — and frustrating — but learning the lingo will lead to a healthier and richer future for you and your family.

If you’re interested in more news and articles like you see here, then subscribe to our newsletters. We’ll deliver, directly to your mailbox, important information about choosing a health insurance plan, understanding your plan, and current news and events that will help you make important decisions about your health insurance needs.

Sources: Association Between Health Insurance Literacy and Avoidance of Health Care Services Owing to Cost, JAMA Network; Journal of Medical Internet Research