West Virginia has a low number of residents without health insurance, so DHI wanted to find out why. We interviewed Joylynn Fix, Director of Health Policy at the Offices of the Insurance Commissioner for the State of West Virginia. She gave the inside scoop on health insurance in West Virginia and what her agency does. (Questions and answers have been edited for clarity and length.)

Q1. What are your main responsibilities as Director of Health Policy at the West Virginia Offices of the Insurance Commissioner?

A: We do all things health insurance throughout all facets of the organization. This includes implementing state and federal legislation related to health insurance and helping consumers.

Q2. How much of what the commissioner’s office as a whole does is related to health insurance vs. other types of insurance?

A: The portion of our work related to health insurance has been growing each year. It wasn’t much 10 to 15 years ago. However, now it’s probably 40 to 50 percent of what our agency does. There are more state and federal laws to implement and comply with, especially in the last four to five years.

Q3. West Virginia uses the federal Healthcare.gov site for individual marketplace insurance. If individuals don’t make enough to qualify for ACA subsidies in the marketplace and can’t afford individual insurance, they would be covered by Medicaid?

A: Yes, West Virginia expanded Medicaid eligibility in 2014. So, we have continuous coverage for individuals at different income levels with no coverage gap between Medicaid and private individual insurance. People who don’t make enough to get subsidized individual insurance are eligible for Medicaid in our state. The Healthcare.gov website takes a “no wrong door” approach. If people go there to apply for insurance and it shows their incomes are too low for ACA subsidies, it transfers them to the state Medicaid system to continue their application and qualify that way.

Expanding Medicaid helped lower our state uninsured rate by making more people eligible for insurance. One measure we’ve implemented that helps consumers who qualify for Medicaid is “presumptive eligibility.” This allows hospitals and other providers to screen uninsured people needing services and to assume they are eligible for Medicaid if this appears to be the case. This allows them to provide needed health care and bill Medicaid before the state has finished processing the application.

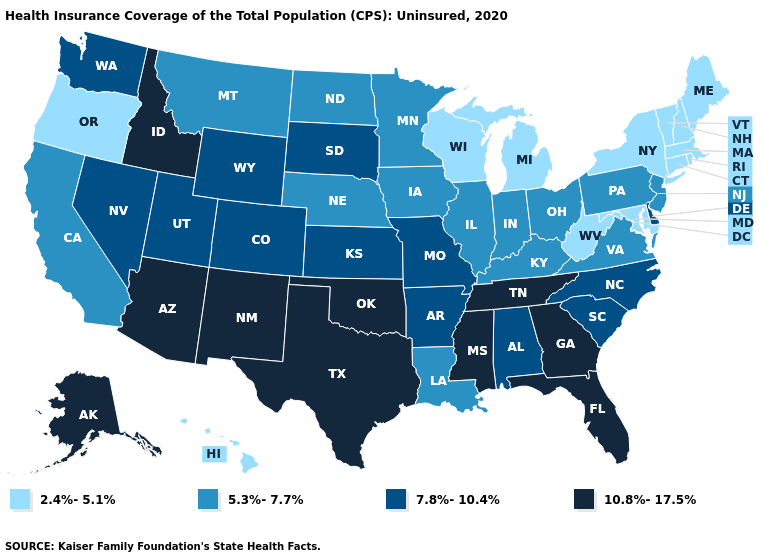

Q4. The West Virginia uninsured rate is very low (5.1% overall and 6.4% of those under the age of 65). Do you know which populations are still uninsured? Is it mainly people who are undocumented and don’t qualify for any insurance?

A: We don’t have a large undocumented population in this state.

The uninsured tend to mainly be:

- those eligible for Medicaid but who haven’t signed up,

- business owners and independent contractors who make too much for ACA subsidies but feel they can’t afford full-price individual insurance,

- and others who just don’t want insurance.

We are trying to get rid of any stigma around being on Medicaid, and we’ve renamed Medicaid managed care in West Virginia to Mountain Health Trust.

Navigators and certified application counselors at FQHCs (federally qualified health centers) and other nonprofits have helped to enroll people in individual insurance and Medicaid. This has lowered our uninsured rate. Grassroots efforts such as these local assisters are very important in our state, where many people rely on relationships and word-of-mouth to get information. Therefore, they are more likely to use local assistance than to sign up on the website themselves.

Q5. Do you have local or state programs that help individuals or small businesses afford health insurance premiums?

A: No, we tend to rely on the federal ACA subsidies for those who qualify to make insurance more affordable.

*Note from DHI: Read about a successful local nonprofit in Texas that helps small business employees afford health insurance. DHI gets an inside look into a program that could be replicated in other areas to help even more people obtain coverage.

Q6. Consumers can file complaints against their insurance companies (health or other types) if they feel their insurance claims were improperly denied or have other issues. Are complaints a big part of what your agency handles?

A: Yes, we have a whole unit, Consumer Services, that handles inquiries and complaints, and they are divided into two teams—Life and Health, and Property and Casualty. This department serves as a liaison between consumers and the insurance industry to resolve problems.

*Note from DHI: Every state has a state insurance department that regulates insurance and protects consumers. You can find insurance information and how to file a complaint in your state at https://content.naic.org/consumer.htm.

Q7. Anything else you’d like to tell people about what your agency does and how it benefits them?

A: We have good relationships with our insurance carriers. We work to be a middle ground between them and consumers so they can offer consumers the best products for the best price. The premium rates charged for all health insurance and some other types of insurance must be approved by our agency.

We are not seeing large premium increases for individual health insurance in West Virginia this year. There was more variability at first, but our individual market is pretty stable now. We have two insurers that offer individual health insurance through the marketplace in our state.

Q8. I know you read Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money. How have you found the book to be most helpful?

A: We have found it to be a great reference for questions that consumers have on health insurance, and we have ordered copies for our Consumer Services department, for the FQHCs in West Virginia, and for others who assist or enroll people into health insurance. Navigators around the state have already found it to be useful. It can help anyone who wants to learn more about insurance terms and about all their options.

*This article was written by Lauren Jahnke, MPAff, author of Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money.