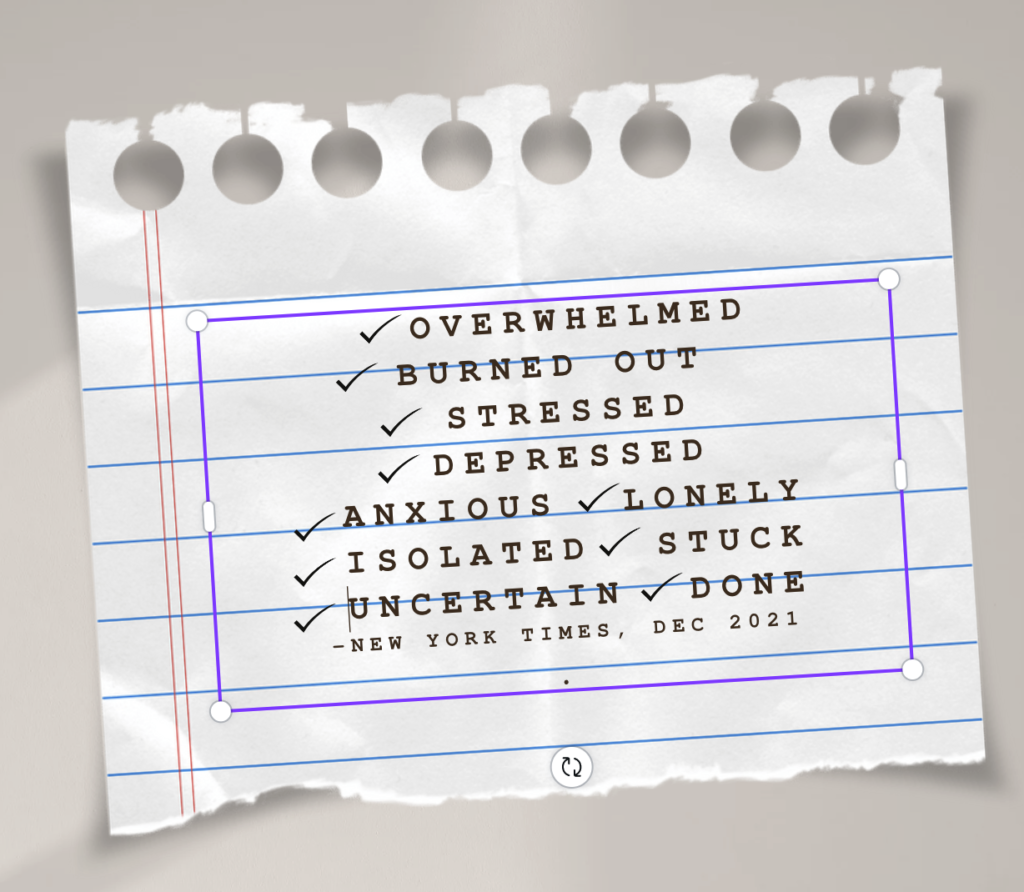

Americans are feeling more blue and uncertain now than at any time in the past 20 years. And no matter who or what is to blame — whether it’s personal finances or the country’s political divide — what’s important to understand is that when people feel depressed and anxious, everything from work to family life suffers.

The only way to turn around this mental health crisis we seem to be in is by giving sufferers an opportunity to get help. On their own, positive thinking and prayer won’t help. But a concrete plan can.

In honor of minority mental health awareness month, we decided to learn more about ways that large and small businesses are helping employees get the help they need.

Mental Health Awareness is Step-One

From about April 2020 to January 2021, at the height of the pandemic, Americans went through one of the roughest patches in a generation. During this period, the percentage of adults reporting feelings of mild, moderate or severe depression and anxiety were through the roof. And this past year, a period when in-office attendance outnumbered remote workers again, the number of adults experiencing mental health symptoms started coming down. The logical response to these numbers would seem to be a feeling of accomplishment. The problem is that we’re far from out of the weeds. Too many adults still feel worried, nervous, troubled or agitated. And when it comes to mental health in the workplace, performance-disrupting levels of stress is a downright epidemic.

For Some Adults, Depression Originates at the Office

The problem with depression and anxiety is that it doesn’t occur in a vacuum. In other words, if someone is feeling melancholy or worried at night — perhaps due to a strained relationship or financial stressors — chances are that person is also depressed at the office. In fact, the Work Health Survey, which asked more than 5,000 employees in 17 industries about their perceptions regarding topics like burnout, workplace stressors, and supervisor support, “85% of respondents reported the workplace itself affects their mental health and wellbeing.”

Is Mental Health Coverage Adequate?

Sadly, many businesses don’t — or can’t — provide access to adequate employee wellness programs. Typically, the reason they provide for skimping on desperately-needed mental health services is that small business health insurance costs are out of control. So when execs look for ways to trim expenses, wellness programs that are not included in group insurance plans are often the first to go. And execs are typically not interested in dropping their small business health insurance plan for one that costs more and has better mental health benefits.

Just to be clear, since 2014, most small group health insurance plans are required to cover mental health benefits. But that doesn’t necessarily mean it’s easy for employees to find the specific services they need, which can include anything from a therapist to in-patient mental health care.

While insurance benefits are often touted as being one of the largest expenses for businesses, the reality is that untreated mental health problems are costing businesses a fortune in this country.

A Better Way to Shop for Small Group Insurance Plans

If you purchase insurance for a business with 50 employees or less (or, in some states, 100), go to the Small Business Health Options Program (SHOP) to see if you’re getting the most for your money. Also, if your company has fewer than 25 full-time employees, it may qualify for a hefty tax credit. Another way to shop the small group insurance marketplace is by working with a broker. See Investopedia’s list, “The 7 Best Small Business Insurance Companies of 2022.”

Calculating the Costs of Depression and Anxiety

The Mental Health Cost Calculator is a tool developed by the National Safety Council (NSC) and NORC at the University of Chicago, a nonpartisan research organization. The project demonstrated that when employers provide support and treatment to employees, they see a $4 return for every dollar invested in mental health.

Every Which Way You Look at it, Employers Pay for the High Cost of Mental Health

The estimated cost of untreated depression, according to the Centers for Disease Control and Prevention (CDC), ranges from $17 to $44 billion and roughly 200 million lost workdays each year. Seeing these numbers, one can’t help thinking that workers are barely getting by under the oppressive thumb of depression and anxiety. Affected employees have higher levels of absenteeism, reduced productivity, and poor morale. Also, as Forbes magazine points out, apathy in the workplace is contagious. According to an article from a year ago, when depression goes untreated, “It can negatively impact social interactions with other employees. If the depressed employee is moody, co-workers may avoid them, leading to isolation, conflict, and poor communication.”

Depression is an illness that doesn’t stop at making someone feel sad or blue. It makes focusing on tasks difficult, it interferes with the person’s ability to make good decisions and they have trouble managing their time. Like other common health conditions, early detection and effective treatment lessens the severity and impact of the condition.

What the data shows, however, is that when companies make it easier for workers to get mental health treatment, they save a lot of money.

Unlike in the past, these days most health insurance plans and Medicaid provide mental health services, including treatment for anxiety, depression, and substance abuse. But a lot of plans, according to the National Alliance on Mental Health (NAMI), are considered inadequate. Mental health coverage adequacy was determined by:

- How long members had to wait before they could get treatment

- How far they had to travel to see an in-network provider

- And how much employees paid out-of-pocket for an out-of-network provider

How to Promote Mental Health in the Workplace

The American Heart Association (AHA) suggests five actions that employers can take to provide a supportive and mental-health friendly environment.

Workers tend to be tightlipped about a diagnosed mental health condition. So when an employer takes the time to voice their support and models acceptance for mental health care and wellness programs, it goes a long way. The AHA suggests that businesses create and share a mental health action plan. It should include training staff to identify when employees are struggling and introducing them to available resources.

A Brand New Mental Health Tool

After this month, we could see some relief on the horizon — at home and in the workplace. Several new states just upped their commitment to helping people experiencing a mental health crisis by introducing an important tool that businesses should tell employees about. A new hotline connects callers with a trained crisis counselor 24-7.

Turning a Page in Mental Health Care

Before this legislation was enacted, people experiencing a mental health emergency had the option of calling an 11-digit hotline associated with the National Suicide Prevention Lifeline. Experts said that few people knew about the hotline, those who knew about it didn’t know the phone number and even most of those who had the number were reluctant to call because they believed it was only for people who were suicidal or were thinking about suicide. To contact the new three-digit crisis line, one only needs to remember 988. It’s a number that’s far easier to remember and it’s for callers experiencing a wide range of acute mental health problems.

States in green are rolling out the 9-8-8 mental health crisis hotline.

Get the Most Out of Your Mental Health Plan Coverage

If you want to understand your group health plan better, start by checking out Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money, a book that provides comprehensive information about all the ways health insurance policies cover workers and their families.

While you’re here, see our Partners Page to see additional health-related products and services that might be of interest to you. For more in-depth health insurance news and information, sign up for our newsletter right now.